Credit Score Update

As I have blogged previously, you must ensure that a program of racking up bonus points doesn’t hurt your credit score. Again, the most important thing is to always pay your bills on time. Then is to make sure that you only use a small percent of your available credit. As many of you know, each “hard” credit inquiry has a negative effect on your credit score. For those who’s credit is otherwise very good, this effect is very small and become negligible after a few months. Also, in many people’s cases their credit score will then start trending up from their baseline as they demonstrate responsibility with their new credit (especially when you are approved for a high limit credit card and only use a small percent).

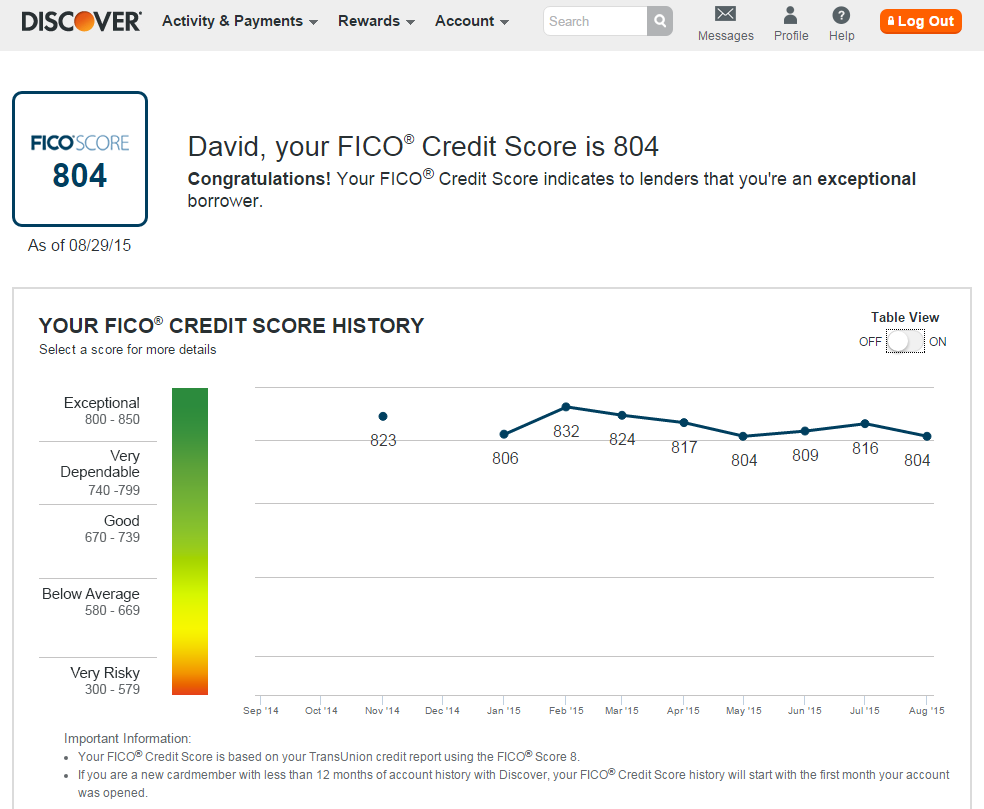

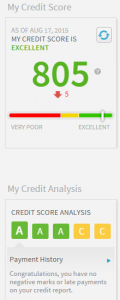

Dave’s Credit Sesame (Experian) Score

My mileage maximization strategy certainly isn’t hurting me, however, everyone is different and they must be very careful if they are starting off with a more borderline score. There isn’t any hard and fast number, but in general, if you are below a 700, I would recommend starting off with a focus on building your score and then switch to points accumulation once you have reached a comfortable place.

Two truly free places to look up your credit score:

- Credit Sesame – Free Experian score every month

- Credit Karma – Free TransUnion and Equifax score weekly

Update:

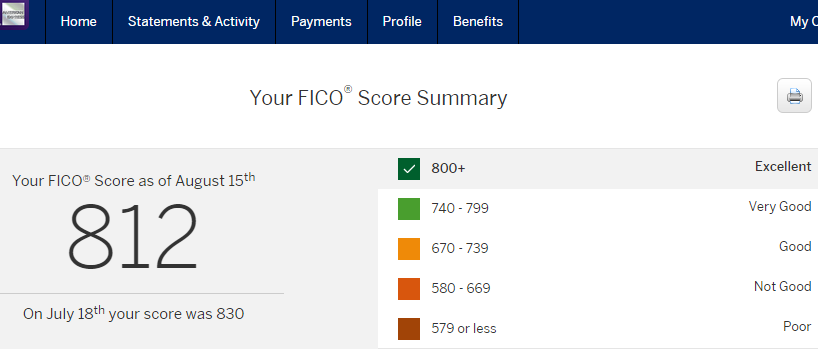

Now many of the major credit card issues are offering free scores. Amex, for example, allows me to access my classic FICO credit score using Experian data directly from their website (see screen grab below).

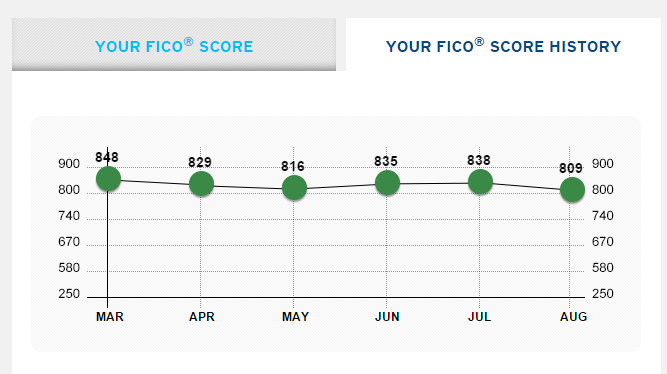

Citibank makes it a bit hard to find, but offers me a FICO Vantage credit score using Equifax data using this link (see screen grab below). Note that the FICO Vantage Score is out of 900 instead of 850 so don’t be too impressed with the 848 I had in March.

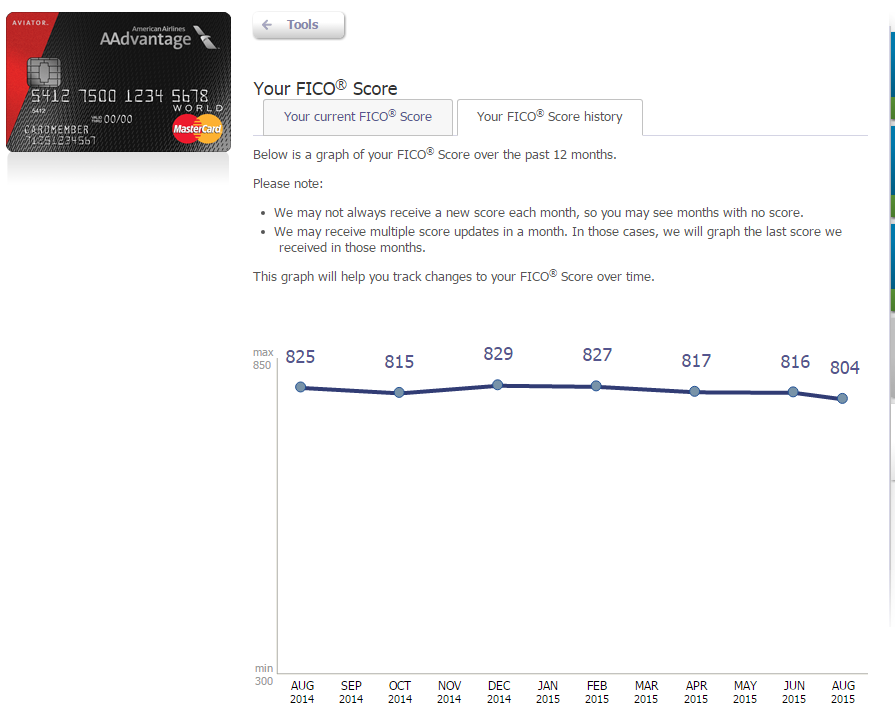

Barclays provides me with a classic FICO score using TransUnion data (see screen grab below).

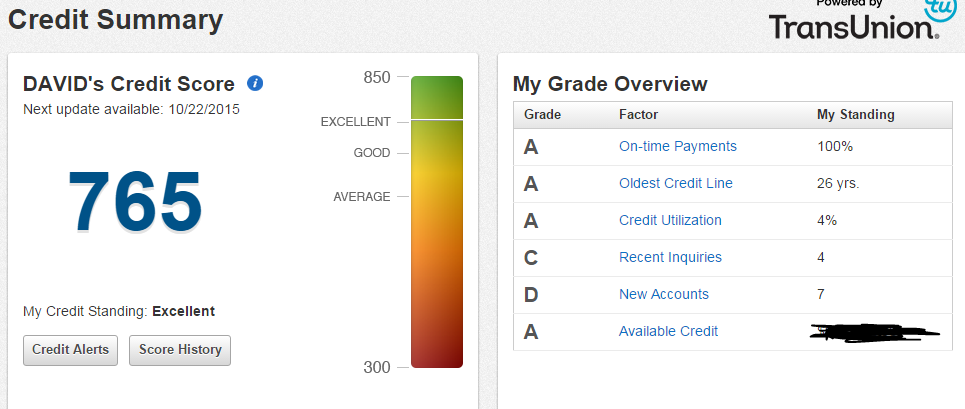

Capital One uses a proprietary “Credit Tracker” score (see screen grab below) from TransUnion presumably to save on licensing fees. Using the same data, this appears to give me a score that is 39 points lower than Barclays. Not an issue, but still a bruise to the ego.

Discover also provides me with a classic FICO score (FICO 8) using TransUnion data (see screen grab below). Note that it lines up perfectly with the Barclays data from the same source in the months they were both pulled.

Other card issues are getting into the game as well.

As won’t surprise any of my readers, the “dings” to my credit reports all come from the number of cards I have recently opened. However, as you can see, even when I practically fail that part of the credit score test, I still maintain a very high score from all of the agencies. The real key to the score is paying your bills on time and keeping your utilization rate low.

Dave

POINTS BLOG

Credit Rating Credit Score FICO Score